If you're already using Quicken or QuickBooks, you can track rental properties fairly easily by assigning properties to classes.

#Quicken rental property manager Patch#

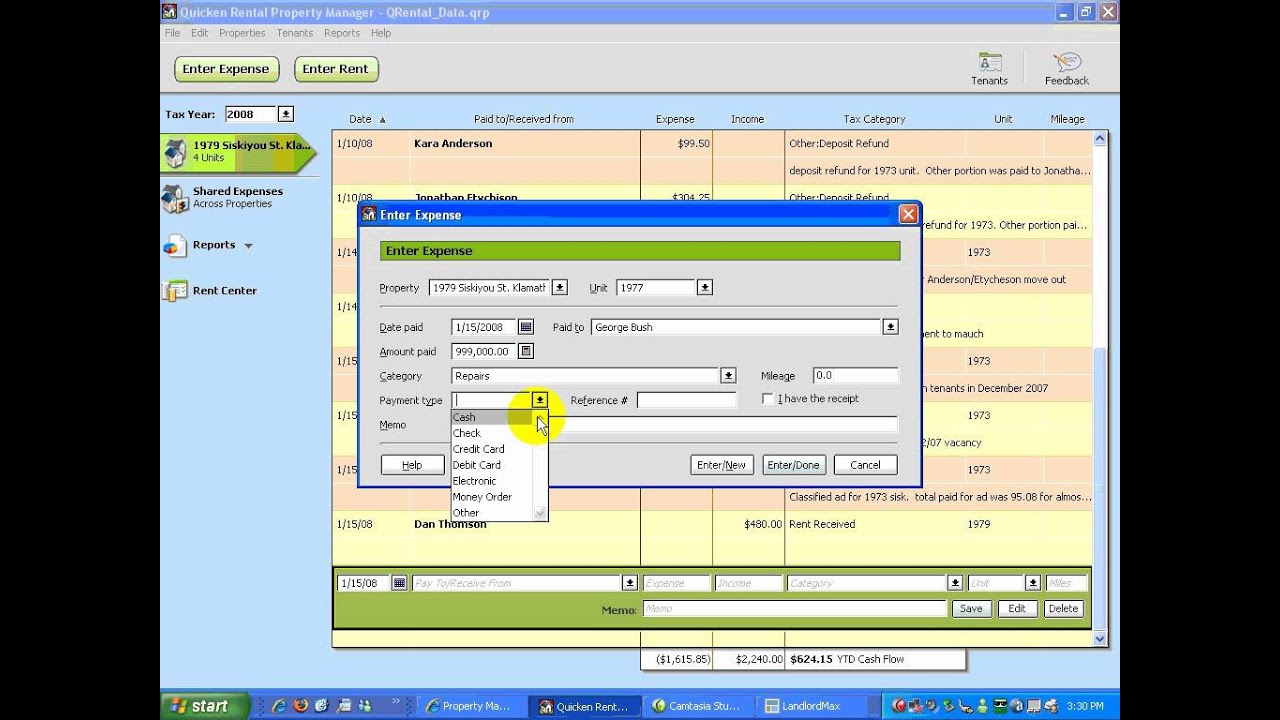

Intuit has released a patch that lets the program export data to TurboTax for the 2004 tax year. An income and expense report provides a categorized version, and a tax report breaks down each property's cash flow into its tax-related categories. Clicking on a property's icon displays a bird's-eye view of each one's running tally, with a cash flow total at the bottom. You can also check a box to indicate that you have a receipt (which makes the IRS happy, of course). The list of Schedule E–related expenditures is lengthier, of course, and there's a Not Sure entry for costs that might require consultation with a tax professional (for example, does that new toilet count as an improvement or a repair?). You can also select from a list of categories to further define the income (like security deposit or rent received), and then enter a note if you'd like, as well as any mileage incurred related to servicing that property.ĭocumenting expenses is a similar process. As rents roll in, you just click the big green button and fill in the stub with the property identifier, tenant, date, and amount.

You define each property by selecting its type (single-family, duplex, and so on) and entering an address (and number of units, where applicable).

#Quicken rental property manager software#

Best Hosted Endpoint Protection and Security Software.

0 kommentar(er)

0 kommentar(er)